WHAT WE OFFER

Your dedicated index portfolio

Keep it simple and performing.

We offer dedicated index portfolios, managed on a discretionary or advisory basis.

Would you like more information ?

About index investing

The first index fund was created by Vanguard in the US in 1976 and the first exchange traded fund (ETF) was launched by State Street in 1993. Yet, until the end of the 20th century, index products were virtually unknown in Europe.

Since then, index products have gained popularity and the number of ETFs will probably exceed 8,000 in 2021.

By comparison, active fund managers try to beat their reference index (benchmark) but charge a higher management fee.

According to the proponents of passive investing, most active managers do not manage to beat their benchmark after fees. In the long run, passive investing delivers better results.

The debate between active and passive investing will go on. There will always be talented active managers and passive investing cannot beat active investing all the time. At Delcap, we do not tell our clients that they should invest only in index funds and ETFs, but that a well-constructed portfolio of index and exchange traded funds should represent a significant part of their portfolio.

Global market index portfolios

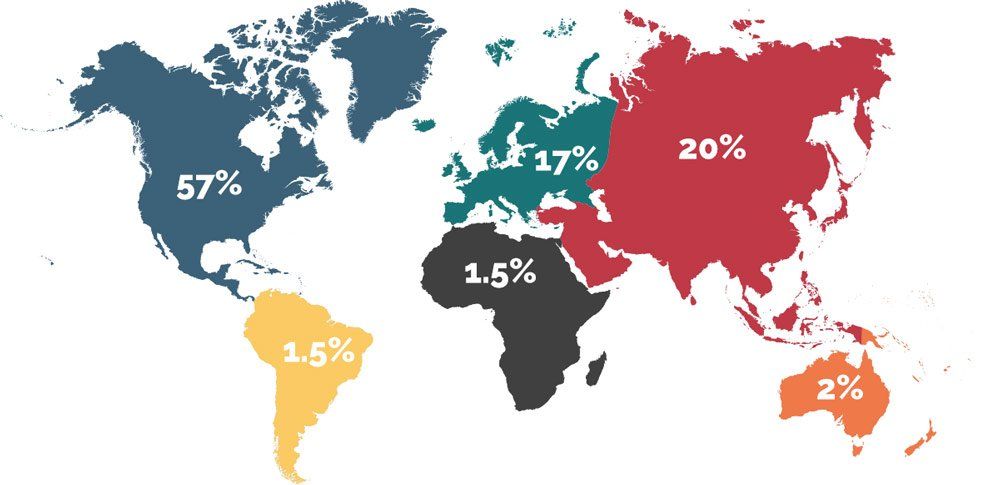

Our global market index portfolios give a truly broad coverage of fixed income and equity markets.

For example, the core product in the equity allocation contains about 1.600 stocks and the core fixed income product contains almost 13.000 bonds.

SRI index portfolios

Our SRI (Socially Responsible Investing) index portfolios offer exposure to companies with high Environmental, Social and Governance (ESG) ratings.

SRI indices follow a two-fold approach :

Exclusion of companies involved in Nuclear Power, Tobacco, Alcohol, Gambling, Military Weapons, Civilian Firearms, GMOs, Thermal Coal and Adult Entertainment.

Best-in-class selection of companies with the highest (best) ESG ratings.

For example, the core product in the equity allocation follows the MSCI SRI. This index contains about 350 stocks and its market value represents about 25% of its parent index, the MSCI World.